Insights from Mooris Tjioe, FX & Rates Analyst with Informa Global Markets (IGM)

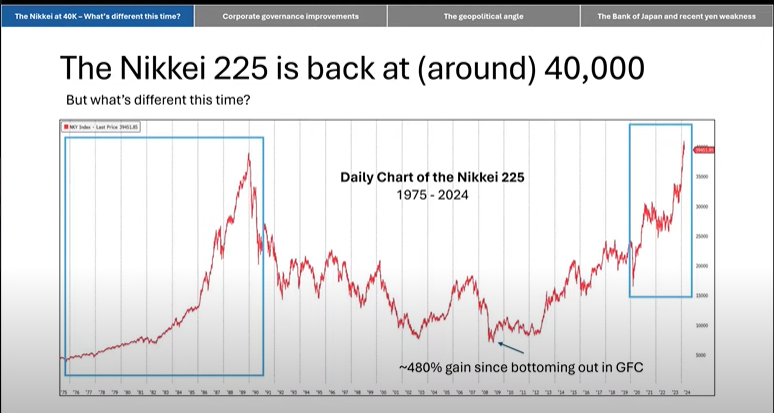

Looking at the current highs of the current highs of the Nikkei 225, one can’t help but notice that we are at the bubble level highs, a key thing to think about is what is different this time?

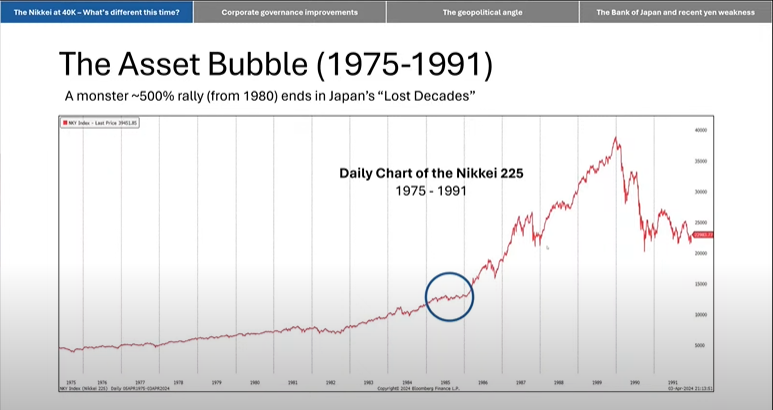

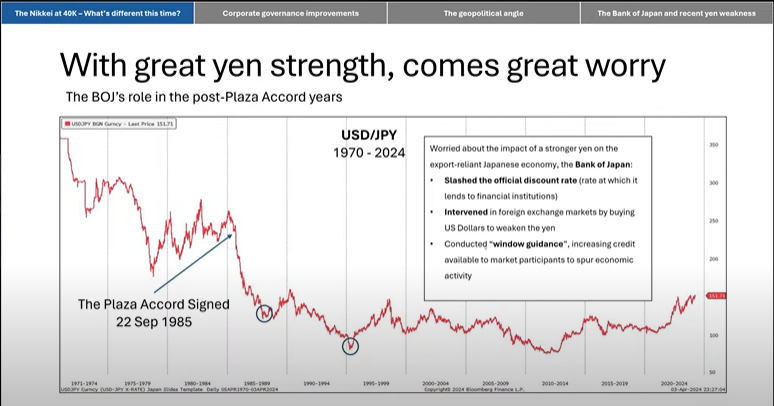

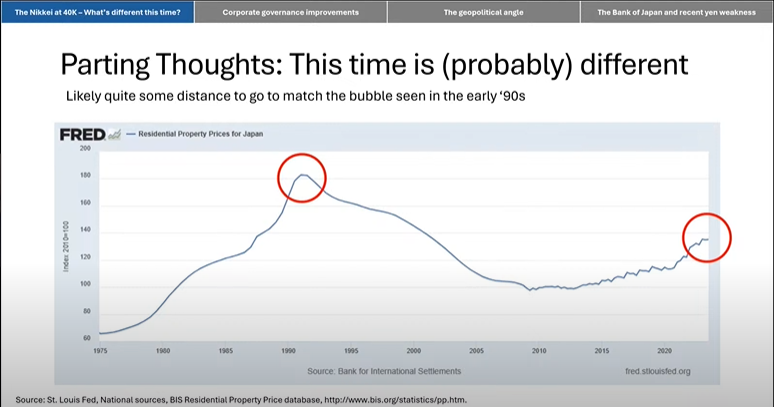

Looking at the chart from the bubble years, we see a sharp run up in stocks from 1985 all the way to 1990. A large reason for this is the Plaza Accord which was signed on 22 September 1985. What is the Plaza Accord? It is an agreement between 5 major economies coming together with a view to strengthen their currencies against the USD.

This was signed during a period where Japan had a strong reputation for manufacturing which enjoyed high demand in terms of exports. However, from what we understand from economics, when your currency strengthens, exports will suffer and this in turn will lead to the economy slowing down. When the currency strengthens too much, with the yen touching the 80 mark during this period, the government will start to considering having an easy monetary policy just to weaken the yen. One of the strategies taken by the authorities to weaken the yen was ‘window guidance’. Window guidance is an informal monetary policy when the central bank issues credit guidance to specific sectors/market participants to strengthen those areas. The BoJ has used this strategy to great effect after WW2 which lead to the rise of several large, still-recognisable Japanese mega corporations.

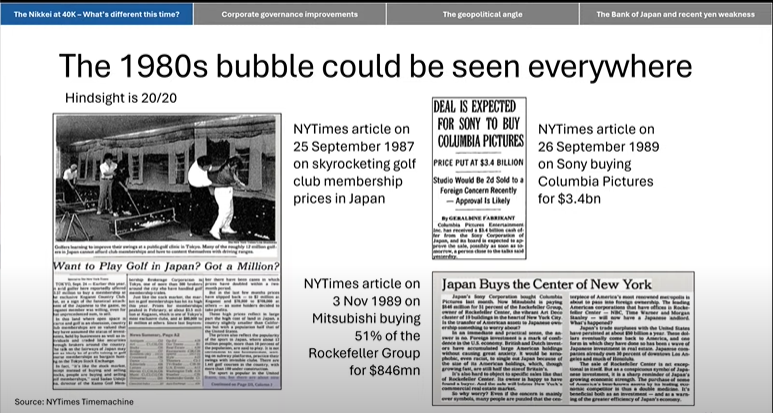

However, during the pre-bubble years, both sectors that were deemed relevant and sectors which were not a priority for growth received credit from the authorities. Many of these firms received surplus credit to what they had actually needed and they then used the surplus to speculate. Some examples from the bubble years include Mitsubishi buying 51% of the Rockfeller Group and Sony buying Columbia Pictures. Drawing parallels with what you see presently, you have Nippon Steel looking to buy US Steel. So is history going to repeat itself? Back then the government expanded credit amid fears that the economy would suffer, but they did so in unproductive ways.

Looking at the above chart on residential property prices in Japan, it looks like we are some way off from the pre bubble peak in the 90s. We do not see a rapid growth currently as compared to what we saw in the bubble years.

One of the key things that analysts have noticed about Japan today is the improvements to corporate governance. Compared to the bubble years, where the Japanese firms were focused on investing for their future, these corporations have now altered their dividend policies to provide a lot more value to shareholders.

With effect from 1 March 2023, as implemented by the Tokyo Stock Exchange (TSE), companies with a price to book ratio of less than 1, they will need to announce their plans to improve valuations and capital efficiency, etc. to the shareholders. Total number of companies falling into this category is about 4,000. Additionally, the exchange has also asked companies to increase disclosure about corporate governance. This has led to a steady reduction of cross-shareholdings from affiliate companies and increased transparency for shareholders.

In just one year, you can see a lot more corporate decisions are being made in favour of shareholders. For instance, companies in Japan are looking to shed property, being increasingly in favour of stock splits and showing increased board member independence.

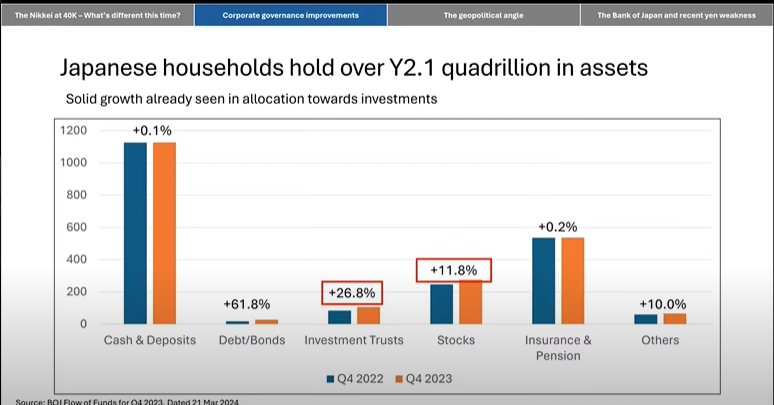

With the changing environment for the yen, you can see increased investments in stocks and investment trusts. However, a large part of their assets are still in cash and deposits. This could be due to trauma from yesteryears, many still do not believe in investing in stocks. Those who are holding large amounts of cash could either be investing overseas (in US focused or broader focused or India focused funds) or simply holding cash because in a deflationary environment, cash becomes more valuable over time. Another reason for the lack of interest in local stocks could be the barrier to entry. For instance, one order of Keyence Corp, with a default lot size of 100 shares is approximately US46K, which is more than the annual earnings of the average Japanese worker.

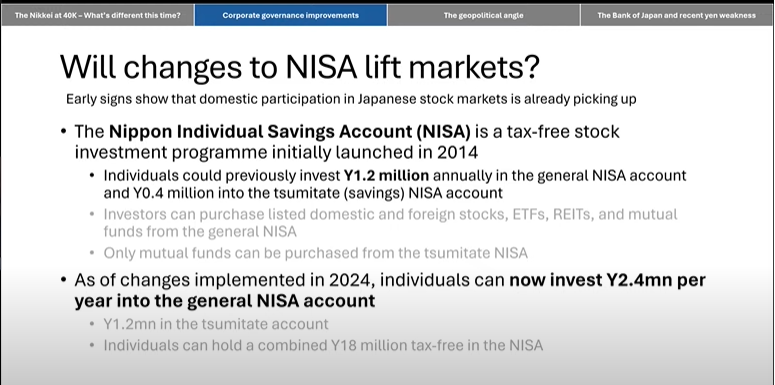

However, with the recent changes to the Nippon Individual Savings Account (NISA) doubling the amount of money that individuals could invest in the NISA, participation in the Japanese stock markets have already begun picking up. Net buying of Japanese stocks have held pretty well one year back and it is showing that the foreigners are liking what they are seeing in the Japanese market. To sum up, traditional valuation ratios show that Japanese stocks remain cheap compared to peers in the US and European markets, speculation on the bottoming of the yen has given some foreign investors the confidence to gain exposure to the Japanese stocks and Japanese banks are expected to maintain higher rates especially from a period where many central banks are looking to trim rates.

One thing for investors to note, especially with there has been very little volatility with BoJ announcements, it seems like it is a very safe period to be investing in Japan as moves seem to be already priced in. For the investor, it seems like investors will not be caught out by surprise movements with BoJ Governor Ueda at the helm who has been in this role for a year.

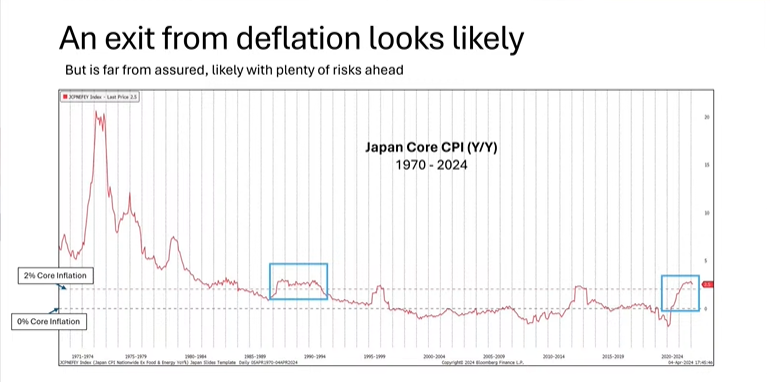

Based on how the index has moved in the last one year, it looks like an exit from deflation is likely. Some key events to look out for is wage negotiations for smaller companies which will take place sometime in August. Additionally, the yen is expected to remain weak with the Japanese yields remaining firmly negative.

Trade opportunities in the Nikkei 225 Futures and the USDJPY on Philip Nova 2.0. Open an account now!

For a more in-depth sharing from Mooris on this topic, please click here to view the recording for our recent webinar.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova