Trade Forex & CFDs with an MAS-Regulated Broker

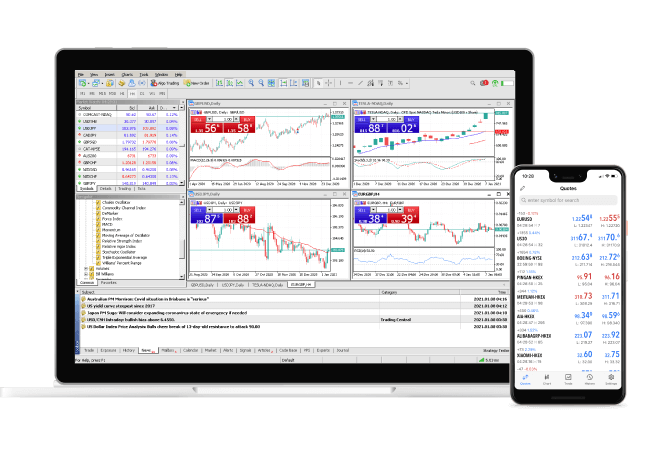

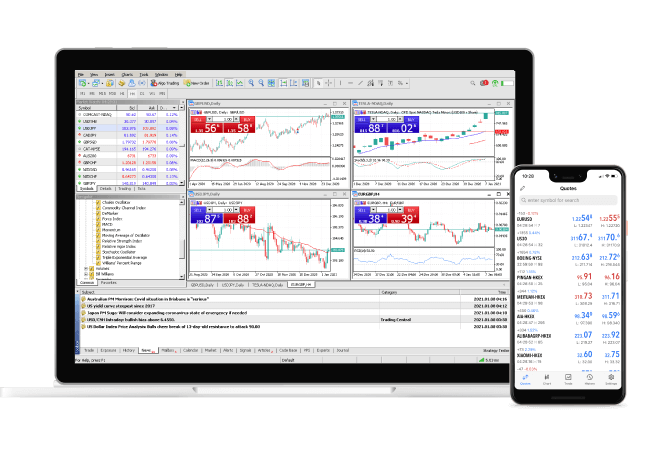

Discover a World of Opportunities with the World-Renowned Phillip MetaTrader 5

Zero Commission Forex & CFDs Trading

| Pairs | Minimum Spread* |

| EUR/USD | 0.6 |

| USD/JPY | 0.6 |

| GBP/USD | 0.7 |

| USD/CHF | 0.7 |

| AUD/USD | 0.6 |

| NZD/USD | 0.9 |

| USD/CAD | 0.9 |

| EUR/GBP | 0.8 |

| EUR/AUD | 1.1 |

| EUR/JPY | 0.8 |

| EUR/CHF | 1.1 |

| GBP/JPY | 0.9 |

| GBP/CAD | 1.1 |

Crypto CFD

Trade popular Crypto CFD like Bitcoin, Ethereum, Litecoin and Ripple on Phillip MT5.

Oil CFD

CFD Spot Brent Crude Oil (UKOIL) and CFD Spot WTI Crude Oil (USOIL) are now available on Phillip MT5.

Global Indices CFD

Popular Global Indices CFD including SPX500, NAS100, HKG50, US30 and CN50 as well as Exotic European Indices CFD such as CAC40, AEX25, IBEX35 and SMI20 are available on Phillip MT5. Margins start from 5%.

Shares CFD

Some of the most popularly traded Shares CFD, including APPLE, TESLA, SNAP INC, TENCENT. MEITUAN, SINGTEL, and DBS are now available on Phillip MT5. Margins start from 10%.

For full list of CFD and contract specs, click here.

*Minimum spreads are indicative. Actual spreads are subject to prevailing market conditions.

Access global markets with over 700 instruments

- 40+ Forex Pairs

- 4 Precious Metals

- 15 Global Indices

- 600+ Shares & ETFs

- 6 Commodities

Trade with Ease Using the World-Renowned Phillip MetaTrader 5

Access a wide range of charting options, technical indicators, and timeframes for precise market analysis.

Utilise advanced order types and stop-loss features to manage risk effectively and protect your investments.

Automate your trades with expert advisors (EAs) and custom scripts for efficient, hands-free trading.

Simplify your decision-making process with high quality and actionable trade ideas from Acuity Signal Centre.

Experience cost-effective trading with peace of mind

Zero Commission* Trading (Shares CFD included)

Minimum commission eating away your profits on Shares CFD? Trade as little as 1 share CFD and pay no commission.

MAS Regulated Provider

Regulated by the Monetary Authority of Singapore (MAS) with over 40 years of experience, ensuring your funds are safe.

Low entry barrier to global indices

Trade indices CFD from 0.1 lot.

(Tick value as low as US$0.01)

24/5 Support Standby

Our dealing and IT teams stand ready to support your trading needs across all market sessions.

FAQs

A demo account uses virtual funds for practice and mirrors real market conditions with live pricing, allowing you to learn and test strategies without risk. A live account uses real money and lets you trade in actual market conditions.

You can trade Spot Forex, Precious Metals and CFDs on Indices, Global Shares, Commodities, Energies and Cryptocurrencies.

Phillip MetaTrader 5 is fully zero commissioned. The only trading costs are spreads and swap (overnight financing charges).

Spreads for major forex pairs like EUR/USD, USD/JPY, AUD/USD are as low as 0.6 pips, while spreads for minor pair like EUR/GBP start from 0.8 pips. Do note that spreads vary depending on market conditions.

Traders choose Phillip MT5 for its advanced charting tools, automated trading capabilities, wide range of markets, competitive costs, and the reliability of a MAS-regulated broker with over 40 years of track record in Singapore.

You can open a live trading account here. No minimum deposit is required.

How to start trading Forex & CFDs on Phillip MT5?

Step 1: Apply

Submit an online account opening form to get started. Apply now!

Step 2: Deposit

Deposit funds with PayNow/Fast Transfer from your client portal.

Click here for full funding options.

Step 3: Trade

3. Start trading once you have funded your new account.

Getting started is easy

Get access to a wide variety of products and trade on our winning platforms.

250 North Bridge Road, Raffles City Tower, #07-01, Singapore 179101 | Copyright © 2024. All Rights Reserved.

Phillip Nova Pte Ltd | A member of PhillipCapital | Company Reg No: 198305695G

Phillip Nova Pte Ltd (Co. Reg. No. 198305695G) holds a Capital Markets Services License issued by the Monetary Authority of Singapore, for dealing in stocks, futures/derivatives contracts and leveraged foreign exchange, and is an exempt financial adviser.

All forms of investments carry risks, and is not suitable for all investors as it can result in losses exceeding deposits or principal amount, therefore please ensure that you fully understand the risks, fees and costs involved by reading our Risk and Disclosure Statements and Disclaimer.

For more information on how we handle your personal information, please refer to our Privacy Policy.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Daily Headlines

Got Questions? Let Us Answer You!

There are no charges for opening a live account. You can view our prices, use our charting tools and full access to our integrated trading tools. Placing a trade will require funds that is more or equal to the initial margin requirement.

There are two key costs to note when trading FX or CFD; Spreads and Holding/Swap Fee (for positions held overnight).

The spread which is the difference between the buying and selling price of an instrument is the key cost for FX & CFD trading. The smaller the difference, the cheaper the cost of trading.

Holding fee for CFDs or Swap Rates for FX is applied to positions held past the specific market close and New York Close respectively. Holding Fees/Swap Rates can be found under “Specifications” on the Phillip MT5 platform.

Margin rates for FX starts from 5% for regular clients. Accredited Investors & Expert Investors are able to receive margin rates from 2%

Margin rates for CFDs varies depending on asset classes. Global indices starts from 5%, equities from 10%, and commodities from 20%.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.