By Danish Lim, Investment Analyst, Phillip Nova

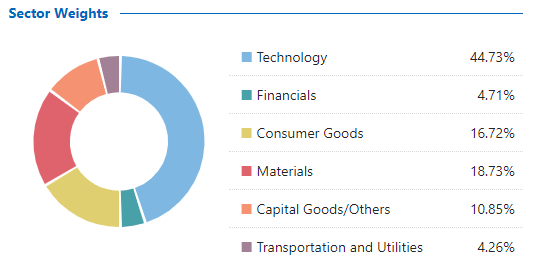

The Nikkei 225 Index has been historically dominated by the Technology sector. Over the past 15 years, the Technology sector has consistently accounted for over 40% of the index, surpassing the S&P 500’s technology weightage of around 30%.

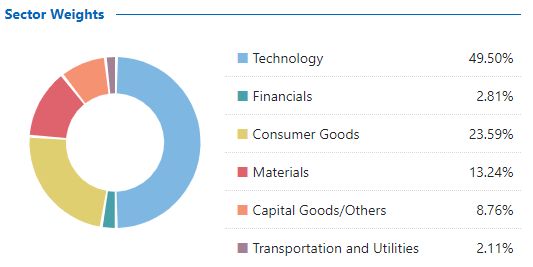

Nikkei 225 Sector Composition as of 24 April 2024:

Nikkei 225 Sector Composition as of 24 April 2009:

As seen above, we observe that semiconductor-related companies like Tokyo Electron, Advantest Corp, and Shin-Etsu Chemical (silicon supplier), have largely overtaken electric machinery manufacturers such as Fanuc (manufacturer of factory automation equipment), and Kyocera.

We think this shift reflects the growing importance of semiconductors in today’s world, mirrored in the explosive growth of semiconductor material and equipment makers in Japan. As chips become more complex, demand for more advanced production equipment will rise, a demand that Japan’s semiconductor industry is well-equipped to meet.

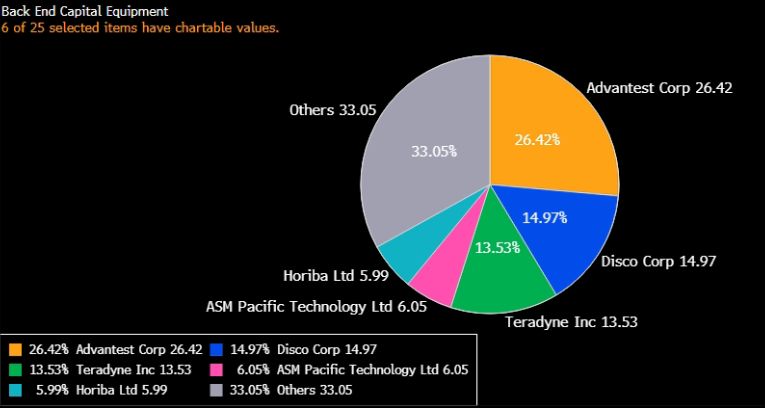

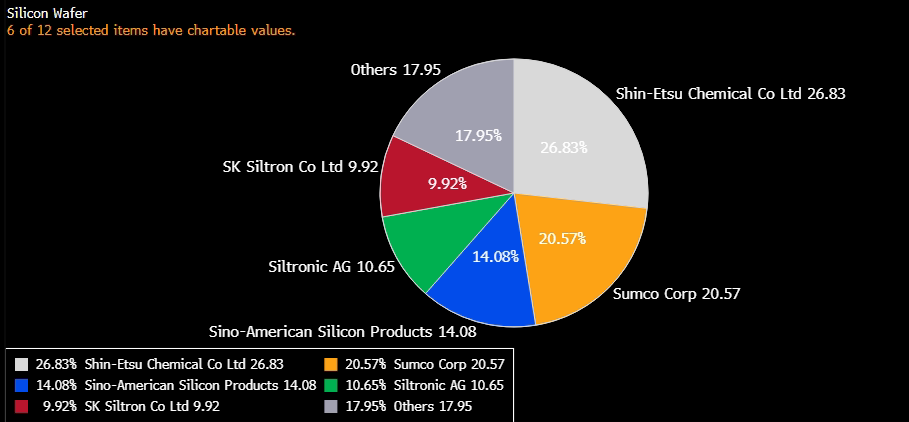

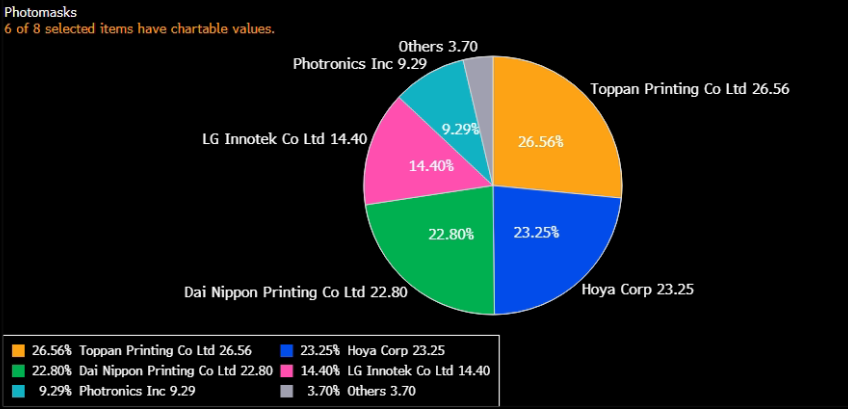

Diving deeper, Japan’s semiconductor industry shows dominance in certain niche markets:

- Back-end equipment manufacturers (after semiconductor leaves the foundry) like Advantest and DISCO command significant market shares

- Japanese companies like Shin-Etsu and Sumco dominate the Silicon Wafer sector (based on 2019 data)

- A similar trend is observed in the photomasks sector.

We believe the Nikkei 225 Index’s substantial exposure to semiconductor-related companies puts it in a good position to benefit from the AI boom and a potential cyclical recovery in the overall semiconductor market, which has been grappling with an inventory glut.

Another observation would be the increased weightage of the Consumer Goods and Transportation & Utilities sector over the past 15 years. Prominent companies in the Consumer Goods sector includes Fast Retailing, the owner of Uniqlo, and video game makers like Konami and Nintendo. Similarly, the Transportation & Utilities sector features companies like Japan Airlines, and East Japan Railway Co.

The return of inflation and wage growth could be beneficial for the Consumer Goods industry, as higher consumer purchasing power will allow companies to start raising prices instead of focusing on managing/cutting costs.

Nikkei 225 Index Futures as an efficient way to gain access to Japan’s Stock Market

The Nikkei 225 Index Futures are offered on 3 exchanges – Singapore Exchange (SGX), Osaka Exchange (OSE), and the Chicago Mercantile Exchange Group (CME Group). Below is a brief comparison of their offerings:

SGX:

- Contract size: 500 yen multiplied by the index futures price

- Tick size: 5 index points or 2,500 yen per contract

- Currency Options: USD and JPY

- Mutual Offset System (MOS): CME Group and SGX have a special arrangement that allows traders of yen and USD-based Nikkei 225 contracts to take positions at one exchange and clear them at the other on the same trading day. This provides flexibility and convenience for traders operating in different time zones.

CME Group:

- Contract size: 500 yen multiplied by the index futures price

- Tick size: 5 index points, or 2,500 yen per contract

- Currency Options: USD and JPY

OSE:

- Contract size: is larger, 1,000 yen multiplied by the index

- Tick Size: 10 index points or 10,000 yen per contract

- Currency Options: JPY only

Trade Now & Fly to Japan Promotion

Win tickets to Japan when you trade SGX Nikkei 225 Index Futures, at only 50 cents, with Phillip Nova. Click here to learn more now.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0