🇸🇬 The Straits Times Index ETF (SGX: ES3) has gained over 11.66% YTD amid strong performance from a number of Singapore’s blue chip stocks. In fact the STI has also outperformed the S&P 500 year to date in 2025. In this latest Market Trends article, we will analyse the top 5 performing stocks in the STI and assess if they are well poised to add on to their gains for the rest of 2025.

1. Keppel Ltd (SGX: BN4)

Last Price: $8.42 (+23.10% YTD)

The net profit for Keppel in H1 FY2025 was S$431 million, +25% y-o-y, driven by asset management and the property markets. Keppel has secured over S$6.3 billion in committed capital year-to-date for its education and data centre private funds.

Pivoted to an asset-light model with S$91 billion funds under management as at June 2025. Through its Sustainable Urban Renewal strategy, acquired and decarbonised green buildings – including a S$462 million office in Jurong Lake District.

Identified S$14.4 billion of non-core assets for monetisation by 2026, with S$7.8 billion already announced.

2. Singapore Exchange Ltd (SGX: S68)

Last Price: $15.82 (+24.18% YTD)

The Singapore Exchange’s FY2025 adjusted net profit rose 15.9% to S$609.5 million on S$1.30 billion revenue. This is an 11.7% profit YoY.

SGX has over 30 companies in IPO preparatory stages on Mainboard and Catalist – this is also the strongest pipeline in years.

Derivatives volumes jumped 17% y-o-y to 25.6 million contracts in Q1 2025, led by FX (+72%) and commodities (+3%).

SGX also launched digital asset initiatives (CLOB trading for tokens, Asia-SC) and mandated TCFD-aligned climate disclosures under its Sustainability Reporting Roadmap. The exchange also expanded global linkages via Managed Derivatives Market Access partnerships with CME Group and Eurex for cross-listed futures.

3. Singapore Telecommunications Ltd (Singtel) (SGX: Z74)

Last Price: $4.06 (+31.82%)

Singtel’s Q1 FY2025 underlying profit rose 14% y-o-y to S$686 million, led by Optus and regional associates (Bharti Airtel, Telkomsel, AIS). Singtel has also announced a S$2 billion share buyback plan funded by asset recycling proceeds. The telecommunications giant has also rolled out a “5G+” network slicing for faster speeds and built-in cyber protection, while scaling digital services across enterprise and consumer segments. Singtel has maintained stable dividends: interim core 5.6 ¢, value-realisation 1.4 ¢; proposed final 6.7 ¢ core + 3.3 ¢ value-realisation, totalling 17 ¢ for FY2025.

4. UOL Group Ltd (SGX: U14)

Last Price: $7.08 (+37.21% YTD)

UOL’s FY2024 EPS of S$0.42 beat consensus by about 15%. While its 2025 revenue guidance sits at S$2.8 billion, in line with analyst forecasts. UOL’s portfolio spans property development, investment properties (offices, malls) and hospitality (Pan Pacific, PARKROYAL), delivering diversified recurring income.

UOL also benefitted from Singapore’s property market recovery with 87% sold at PARKTOWN Residence launch. The tourism rebound is also driving higher hotel and office occupancy rates. UOL’s net gearing at 0.23× and NAV per share of S$13.65 as at end-2024, reflects a strong, conservative balance sheet.

5. Singapore Technologies Engineering Ltd (ST Engineering) (SGX: S63)

Last Price: $8.83 (+89.48% YTD)

Aerospace & Defence segments delivered double-digit earnings growth, fuelled by the global aviation recovery and new defence contracts. Smart City & Digital Solutions arm has won over 800 projects in 150+ cities worldwide, spanning smart mobility, IoT lighting, water and waste management, and security systems.

Targets S$17 billion in group revenue by FY2029, with net profit CAGR expected to exceed revenue growth by up to five percentage points.

Four core divisions: Aerospace; Defence & Public Security; Smart City & Digital Solutions; Technology & Innovation – provide diversified, resilient revenue streams.

Investing in AI, robotics, and automation at its new Ezhou MRO facility to boost operational efficiency.

Add these bubbling Singapore market opportunities into your watchlist now!

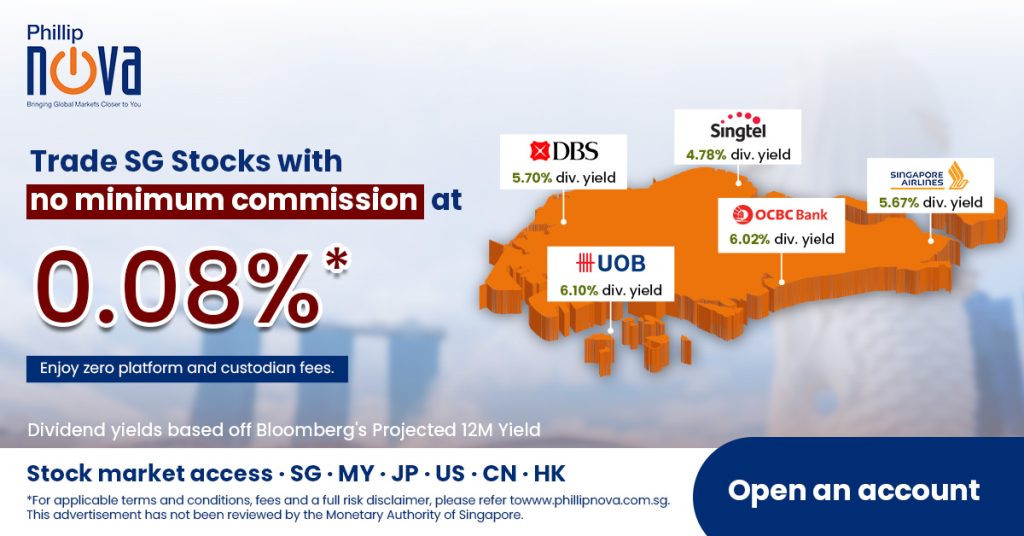

Trade Singapore stocks (with no minimum commission) on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks on NOVA

Features of trading on NOVA

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges - Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets. - Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators - True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on NOVA - USD Shares Margin Rate at Only 4.5% p.a

- Fractional Shares from US$1