The Chinese yuan, or renminbi, exists in two forms: CNY, the onshore currency traded within mainland China under capital controls, and CNH, the offshore yuan that is not under capital control and is accessible to global investors. Although prices of the two currencies differ briefly, CNY and CNH typically move in the same direction.

At the time of writing on Sept 2025, CNH has strengthened against the U.S. dollar, with USD/CNH sliding from above 7.40 in April to nearly 7.11, helped by a softer U.S. dollar, a narrower China–U.S. yield gap and a stronger Chinese equity market.

Drivers of CNH value

Interest-rate and yield differentials

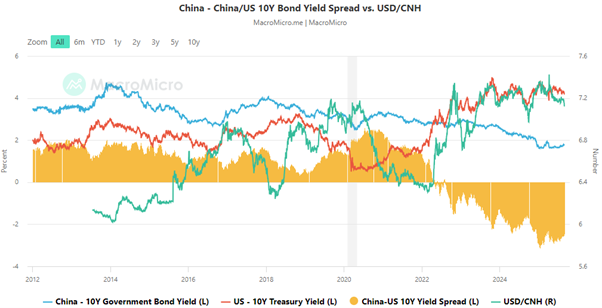

One of the biggest short-term drivers of CNH is the U.S.-China yield gap. When U.S. bond yields rise above China’s, Chinese corporates tend to hold more U.S. dollars which often weakens CNH. When China’s yield exceeds U.S. yields and the gap widens, CNH often stabilizes or strengthens. The correlation is time-varying as policy moves in two countries can mute or amplify it.

This pattern is visible from 2020 to 2024: as the China–US 10-year yield spread (orange band, China minus US) widened on the positive side, the USD/CNH trended lower with a stronger yuan; as the spread flipped and turned more negative, the USD/CNH trended higher with a weaker yuan.

Source: MacroMicro

Another unique element is the offshore CNH money market. In Hong Kong, the CNH Hong Kong Interbank Offered Rate (HIBOR) can spike if authorities tighten liquidity, making it expensive to short the yuan. These sudden funding squeezes can trigger sharp, short-term rebounds in CNH even when interest-rate differentials point the other way.

The PBoC’s daily fixing band

Every morning at 9:15 a.m. Beijing time, the People’s Bank of China (PBoC) sets a reference rate for USD/CNY, known as the “daily fix.” Onshore yuan trading is anchored within a ±2% band around this rate. Although CNH is offshore and not banded, it typically reacts to the daily fix. If PBoC sets a stronger-than-expected fix, it tells the market that authorities want to support the yuan, and CNH (the offshore yuan) often strengthens accordingly. A weaker fix rate tends to do the opposite.

Economic growth policies

Beside monetary policies, fiscal policies also matter as markets read them as signals of authorities’ commitment to economic growth. Policy announcements on areas like government spending, infrastructure, technology investment and property policies can shift expectations for the yuan. When growth outlooks improve, corporates and investors are more willing to buy CNY, supporting CNH. On the other hand, weak or delayed policy action can fuel pessimism, capital outflows, and more selling of CNH.

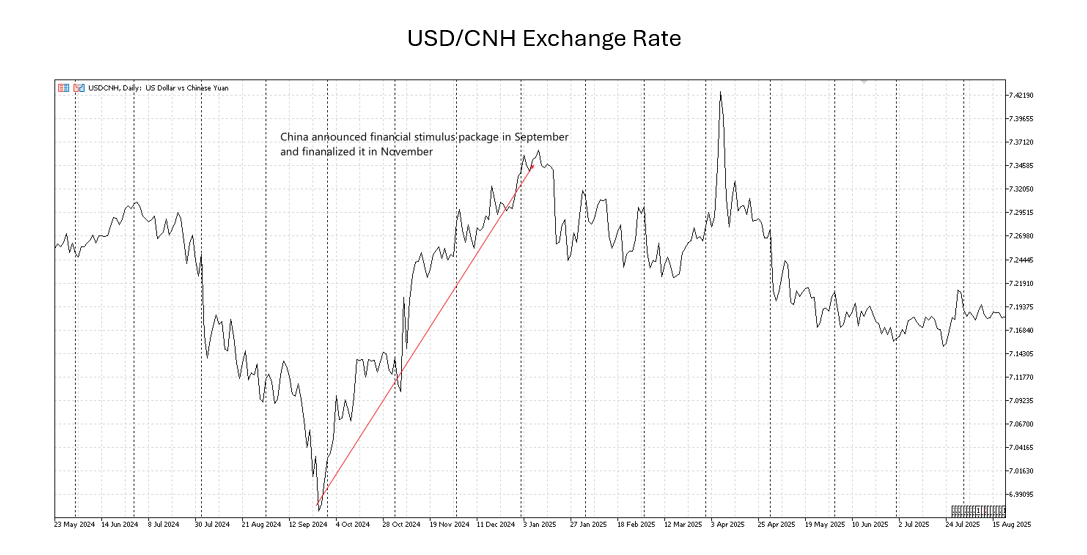

In September 2024, Chinese government’s announcement of fiscal stimulus including a local-government debt restructuring plan has fell short of market’s expectation, coinciding with a sharp yuan decline from September to end of 2024.

Source: Phillip MetaTrader 5

Why should traders look at CNH

Growing CNH turnover

Over the past decade, CNH has transformed from a niche currency into one of the most traded currencies globally. The Bank for International Settlements (BIS) 2022 survey ranks RMB (driven by CNH trading) as the fifth-most traded currency globally, with daily turnover exceeding $500 billion up from about $60 billion in 2010.

CNH derivatives have also grown rapidly. For instance, SGX USD/CNH FX Futures traded volume gained 25% year-on-year in August to 3.4 million contracts, lifting total futures volume on SGX FX by 33% year-on-year to a record 5.6 million contracts.

Expression of Chinese economy and equity market

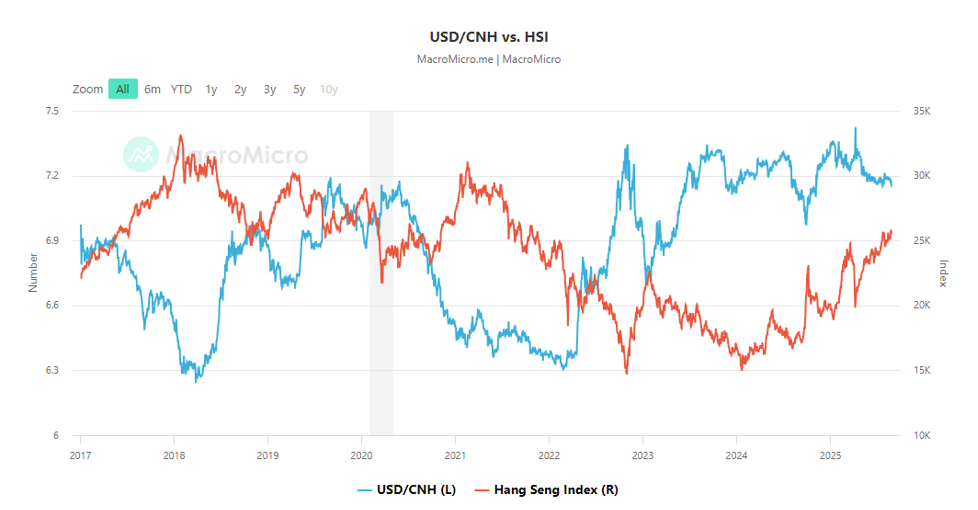

CNH acts as a real-time barometer for China’s economic outlook because it trades freely and reflects global flows in and out of Chinese markets. Historical data shows that moves in USD/CNH have often been inversely correlated to swings in Hang Seng Index: a stronger CNH (lower USD/CNH) tends to coincide with firmer HSI and vice versa. Similarly, USD/CNH can also offer clues about foreign participation in the A-share market.

Source: MacroMicro

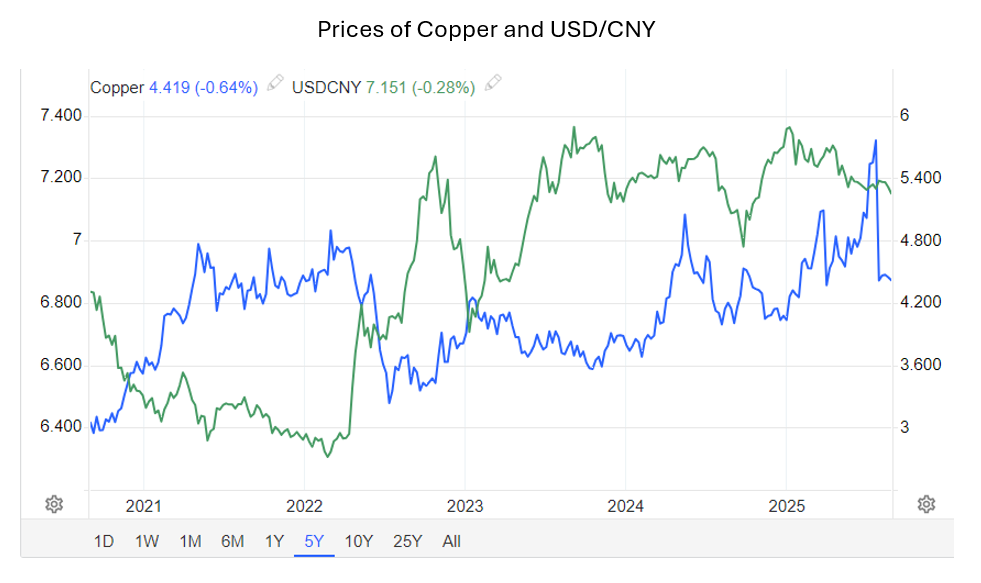

The correlation between yuan and commodity prices

For metals and energy, CNH and commodity prices are often linked through the China-demand channel. For example, copper prices and USD/CNH or USD/CNY often move in opposite directions. The link, however, can fade when U.S. or Chinese policy dominates currency moves. So, many hedgers tend to use USD/CNH as a supporting signal rather than a stand-alone hedge.

Source: TradingEconomics.com

Benefits and opportunities of holding exposures to CNH cross pairs

Use cases of CNH pairs in hedging

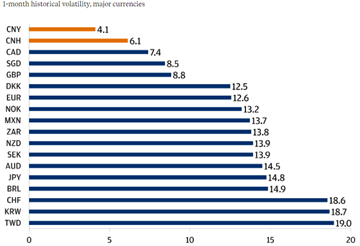

CNH usually moves less day-to-day than many other currencies and its monthly volatility against USD was around 4.1% as of May 2025, according to Bloomberg. For hedgers, the steadier moves mean smoother mark-to-market, fewer surprise margin calls, and simpler position sizing. If you receive or hold CNY, you can set hedge sizes with more confidence than you might with jumpier currencies.

Source: Bloomberg Finance L.P.. Data as of May 2025

Using CNH cross pairs (e.g., EUR/CNH, JPY/CNH) lets companies hedge the invoice currency directly against RMB, without routing through USD. That usually keeps the hedger closer to actual cash flows and removes an extra USD leg.

Example: A Chinese exporter invoiced in EUR can sell EUR/CNH for the invoice value.

- If EURCNH falls, the hedge profits offset receiving fewer CNY on conversion.

- If EURCNH rises, the hedge loses but conversion rate is more favourable.

Without crosses, the hedger needs to look at two trades, EUR/USD and USD/CNH, which make it more likely to have over- or under-hedge.

Trading opportunities

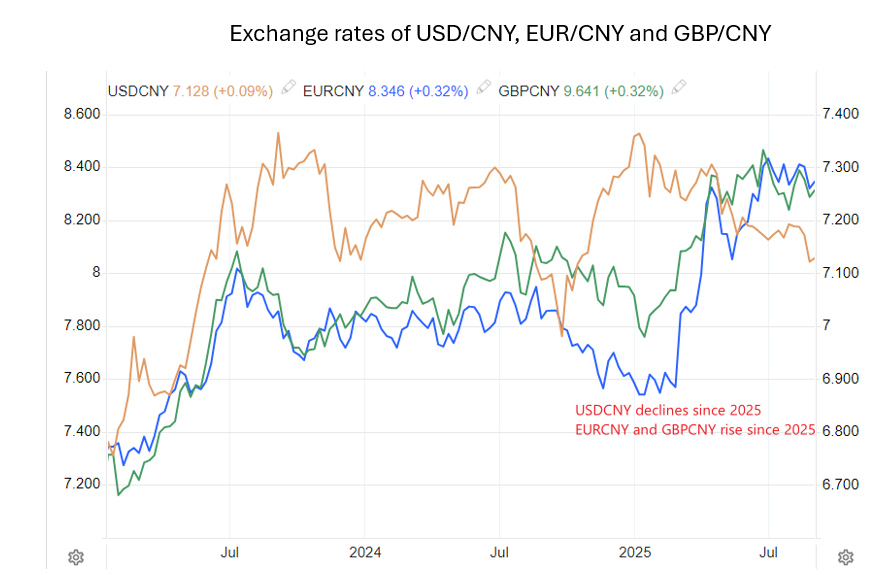

Since early 2025, the yuan has been firmer against the U.S. dollar, but weaker against other major currencies such as euro, pound, and Canadian dollar. Two forces are at work:

- China’s large trade surplus and net foreign-asset inflows put upward pressure on the yuan.

- PBoC controls yuan from appreciating too much to protect exporters. According to Bloomberg, China’s state banks have been lending dollars in the offshore forex swap markets and borrowing yuan, which controls demand for yuan. This caused CNY or CNH to appreciate against USD more slowly than other major currencies, so CNH has weakened against those currencies.

So, what does this mean for traders?

- Short term: USD/CNH often bounces after quick drops, because banks buying tends to appear on dips. That favours range trades (buying near recent lows, selling near highs) in small amounts and quick scalps with tight stop-losses.

- Medium term: CNH cross pairs tend to be more stable than USD/CNH. Use them when you want your trade/hedge aligned to CNY cash flows.

- The current trend can fade if the macroeconomic situation shifts. For instance, if China’s net exports slow in the second half of the year, capital inflows will decline, driving lower demand for yuan. In that case, the trend of USDCNH may rebound or become range-bound.

Source: TradingEconomics.com

Pairs like AUD/CNH and CAD/CNH often move with the big commodities their economies sell—iron ore for Australia and oil for Canada. Those commodity prices tend to swing too far and then drift back toward a normal level over time, and the FX crosses also have mean-reverting patterns. A practical approach is to compare the cross with its recent average (e.g., the last 12 months). If AUD/CNH or CAD/CNH is well above that average, consider a sell aiming for a move back toward the average level. If it is well below that average, consider a buy. Always use clear stop-losses and modest size: the commodity link comes and goes, and big USD moves, or China policy signals can override the pattern.

Conclusion

In summary, CNH reflects the interplay of yield differentials, policy signals, and China’s growth outlook in near real time.

Why trade CNH pairs:

- Macro exposure: CNH reacts to changes in U.S.–China interest-rate spreads, policies and key economic data, creating event-driven opportunities.

- Hedging Efficiency: CNH crosses (e.g., EUR/CNH, JPY/CNH) let firms hedge invoiced currency directly vs RMB in one trade.

- Commodity and equity correlations: CNH trends often correlate to China-sensitive major commodities and Hong Kong equity index, providing signals.

Trade CNH pairs like USDCNH, SGDCNH, EURCNH, GBPCNH, CNHJPY and more on Phillip Nova 2.0 and Phillip MetaTrader 5 — hedge currency risks, capture policy moves and tap on China’s market trends.