DBS (SGX: DO5) shares jumped 3% to close at S$54.80 on Tuesday, 7 October 2025, marking a new all-time high and extending a rally that has lifted the stock close to 25% year-to-date.

The strong performance pushed the bank’s market capitalisation past S$150 billion, nearly double that of OCBC, its closest rival. In June, DBS also became Singapore’s first listed company to exceed US$100 billion (S$129 billion) in market value, aided by a weaker US dollar.

Analysts say investor enthusiasm for DBS is underpinned by its resilient earnings, strong capital position, and consistent shareholder returns. The bank has managed to sustain solid net interest income, achieve record fee growth from its wealth management and credit card businesses, and deliver steady dividends and buybacks.

They add that DBS stands out for its operational efficiency, balance-sheet strength, and predictable cash flow, making it a preferred pick in an uncertain global environment. With expectations of U.S. rate cuts and a benign credit cycle, analysts see DBS as offering both stability and income growth, aligning with investor appetite for clarity and quality.

Meanwhile, government initiatives such as the “Value Unlock” package and the Equity Market Development Programme have further lifted sentiment toward Singapore equities, prompting analysts to raise STI price targets. The Singapore Exchange’s launch of the iEdge Singapore Next 50 Index also signals a broader effort to deepen market participation beyond the benchmark 30-stock STI.

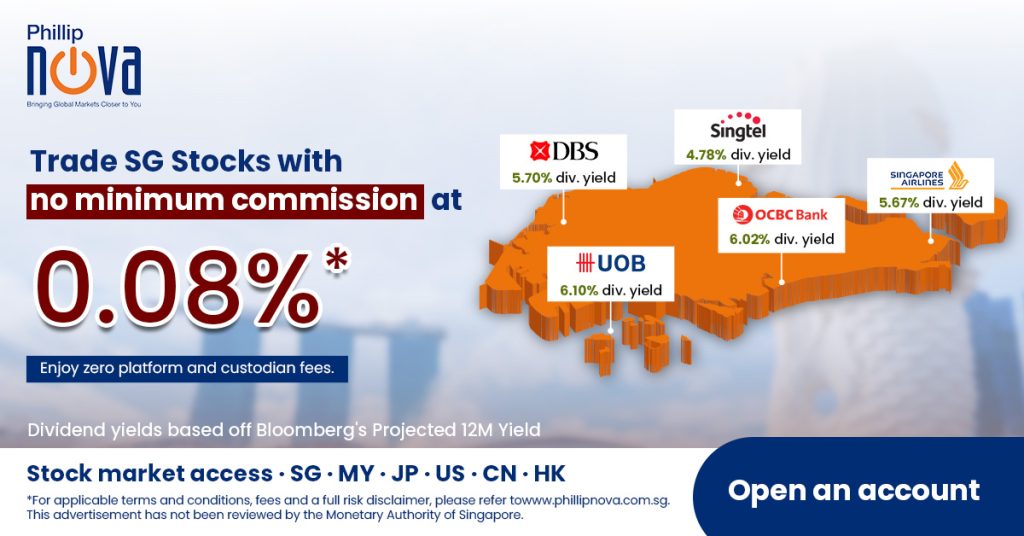

Trade DBS and other SG Stocks with Phillip Nova

Amid a backdrop of a rising Singapore index, enjoy 0.08% commission with no minimum fee when you trade Singapore stocks on our platform. Click here to open an account now!

Or take a view via Singapore index ETFs, CFDs and Futures now.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0