(Data accurate as of 10 Oct 2025)

The Straits Times Index (+15.68% YTD) hit a new record:

- Singapore equities rose +8.47% in 3Q25, the strongest quarterly performance since 1Q22.

- The 3-month SORA at 1.41%, down from 3.07% at end of 2024.

Markets are pricing in 2 more cuts in 25’ and 3 cuts in 26’

- vs Dot Plot: 2 more cuts in 25’; 1 cut in 26’

Multiple milestones ahead: Oct and Dec Fed Rate Decisions; 31 Oct – 1 Nov Trump-Xi Meeting

As of 10 October, market close:

- STI: +0.71% Sept, +21.93% YTD

- iEdge SG Next 50 Index: +2.60% Sept, +23.08% YTD

- FTSE ST All-Share (Top 98% by mkt cap): +0.87% Sept, +21.69% YTD

- iEdge S-REIT Index: +1.93% Sept, +14.77% YTD

- FTSE ST Banks Index: -0.23% Sept, +17.03% YTD

- FTSE ST Mid Cap: +3.15% Sept, +16.85% YTD

- FTSE ST Small Cap: +3.00% June, +28.63% YTD

Small and mid-cap stocks outperformed in September, fuelled by a combination of strong earnings and valuation expansion.

3Q Review:

Biggest gainers in 3Q were in shipping, property, and construction.

- Yanzijiang Shipbuilding (3Q: +51.80% | +5.69% YTD)

- City Developments (3Q: +33.94% | +37.42% YTD)

- UOL Group (3Q: +26.38% | +55.62%YTD)

- Propnex (3Q: +120.64% | +162.21% YTD)

- Wee Hur (3Q: +51.62% | +94.75% YTD)

- Yanlord Land (3Q: +48% | +6.82% YTD).

- Small-mids saw positive impact from MAS’s S$5bn EQDP

- Room for further multiple expansion, with more than half the amount yet to be invested.

Leading large-cap gains YTD have been ST Engineering (3Q: +11.09% | +77.68% YTD).

- NATO members have agreed to raise annual defence spending from current floor of 2% of GDP to 5% of GDP by 2035.

- 23% Revenue in US, 19% in Europe, 51% Asia.

- Group noted that as airlines have expanded networks and more aircraft have returned to service, demand for Maintenance, Repair and Overhaul (MRO) has strengthened.

China-Related Stocks:

- Yanzijiang Shipbuilding (3Q: +51.80% | +5.69% YTD)

- Yanlord Land (3Q: +48% | +6.82% YTD).

- Sasseur REIT (3Q: +10.99% | -0.13% YTD)

Technology Stocks:

- AEM (3Q: +21.33% | +22.92% YTD): Semiconductor test systems. Intel is biggest customer.

- UMS Integration (3Q: +5.31% | +32.04% YTD): Component manufacturer, Applied Materials largest customer.

- Frencken (3Q: +13.71% | +24.78% YTD): Component manufacturer for lithography giants, notably ASML. [REMA]

Banking Sector:

Banks were mixed, with DBS outperforming peers. Three local banks all reported NIM compression in 2Q25, guided for more if Fed cuts again.

But volatile market conditions helped boost capital market and non-interest income.

Banks that payout less underperformed.

- DBS (+19.85% YTD), UOB (-3.62% YTD), OCBC (+1.85% YTD)

- US banks saw a boost to investment banking and equity trading, but we note that SG’s 3 local banks have much less of a focus on investment banking relative to US peers.

Analyst Opinion:

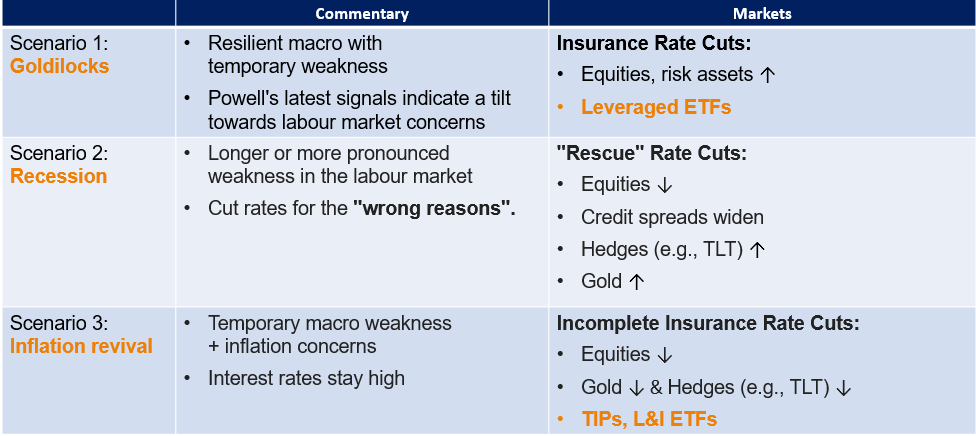

Risk-sentiment should remain strong on expected “insurance rate cuts”.

- Even with 2 rate cuts, FFR of 3.50%-3.75% (vs 30-year mean of 2.50%) should still be able to contain tariff-driven inflation.

- 10 October: S&P 500 -2.71%, STI -0.30%, iEdge Next 50 -0.88%, Gold +1.03%, TLT +1.61%

- Long-duration treasuries and Gold as a hedge for downside risks in 2026.

POSITIVE on Singapore due to its haven status and defensive appeal, with a dividend yield of ~4.8%.

- Reciprocal tariffs are low compared to Asian peers.

- Valuations: Currently below the 10-year average of 14.9x at a TTM P/E of 13.5x. (-9.4% discount)

- Companies are becoming more aggressive in returning capital to shareholders via higher payouts and share buybacks.

- As of 11 Sep, open market buyback consideration hit S$1.65b, up ~80% YoY. Led by SG banks.

In a low-interest rate backdrop, we favour small-mid caps (EQDP) and S-REITs.

- More upside ahead as rates come down, with likely change in Fed chair in May 2026.

POSITIVE stance on S-REITs:

S-REITs at forward dividend yield of 5.78% and at a P/NAV of 0.97x (-0.4x s.d.), which we view as an attractive entry point with interest rate cuts on the horizon.

- A forward dividend yield spread of ~4% against MAS 10yr Bond Yield

- Should see lower finance costs due to interest rates decreasing. Most REITs already reported interest savings.

- S-REITs have reported minimal impact from tariffs. Potential effects are likely 2nd or 3rd order in nature, for example via lower consumption due to a slower economy.

- We favour AI-related, retail and Purpose-built Student Accommodation (PBSA) & Purpose-Built Worker Accomodation (PBWA) REITs, supported by positive rental reversions.

Stock to Watch:

Centurion Accommodation REIT’s (CAREIT | SGX: 8C8U):

- Listed on 25 Sept, the first pure play purpose-built worker and student accommodation REIT.

- Benefit from sustained demand for foreign labour, alongside a controlled supply of housing.

- UK and Australia supported by strong demand for higher education and limited availability of suitable student housing

Scenario Analysis

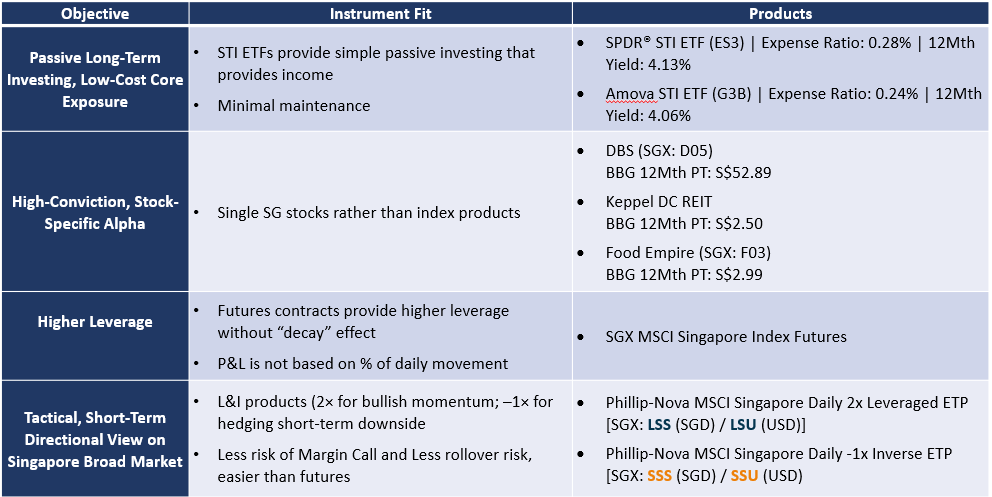

Ways to take a view in the SG markets

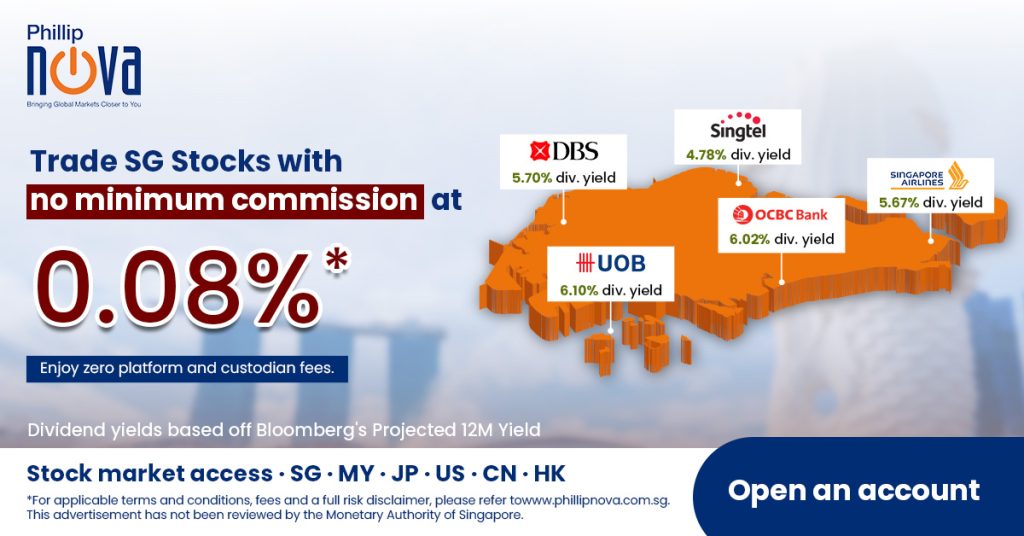

Trade SG Stocks and ETFs with Phillip Nova

Amid a backdrop of a rising Singapore index, enjoy 0.08% commission with no minimum fee when you trade Singapore stocks on our platform. Click here to open an account now!

Or click here to learn more about our special promotion for the Phillip-Nova MSCI Singapore Daily L&I Products now.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0