The MSCI Singapore Index (SIMSCI) ended the transition into 2026 on a high note, supported by stronger-than-expected economic data and positive analyst sentiment for its heavy-weight constituents.

Index Performance for 7 Jan 2026

The index saw a further gain of approximately +0.85%, consolidating its position above the 450 level. According to Trading Central Indicators, we are currently seeing a bullish bias for the index:

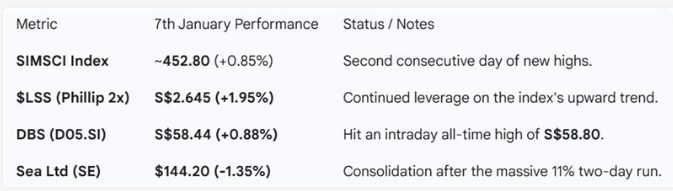

Summary of how key Singapore market products performed:

🔔 Analysis on Major Constituents

- Sea Limited (NYSE: SE)

- Analyst Upgrade: On Jan 2, Maybank upgraded Sea Ltd from “Hold” to “Buy”, maintaining a price target of $156.

- Market Reaction: The stock rose 3.3% on the news. Analysts cited the 36% pullback from 2025 highs as “overdone” and expressed confidence in Shopee’s VIP program and the upside potential of its financial arm, Monee.

- The “Big Three” Banks (DBS, OCBC, UOB)

- DBS & OCBC: Both stocks closed 2025 near record highs. Analysts noted on Jan 2 that while Net Interest Margins (NIM) will face pressure in 2026, DBS remains the best positioned due to its $78 billion in fixed-rate hedges rolling off later in the year.

- UOB: While lagging slightly behind peers due to Q3 provisions, UOB is expected to see credit costs normalize in early 2026.

- Dividends: Research published during the week confirmed expectations for 5%–6% dividend yields across the trio for FY2026.

- Digital Core REIT (SGX: DCRU)

- Strategic Win: On Jan 2, the REIT announced it had secured a 10-year agreement with a major cloud provider for its facility in Northern Virginia, significantly improving its portfolio’s weighted average lease expiry (WALE).

- Real Estate & Other News

- PropNex: Announced on Jan 2 that a high-profile lawsuit against the company had been dropped, removing a minor overhang on the stock.

💡 Investor Takeaway

Strong Singapore GDP growth continues to support confidence in key index constituents—particularly banks and domestically oriented names. In the absence of major stock-specific disruptions, the market is entering 2026 on solid fundamentals, with investor sentiment tilted toward measured optimism rather than aggressive risk-taking.

Take a View Now

Take a view on the SG market by trading the Phillip-Nova MSCI Singapore Daily L&I Products now. Learn more about our exclusive promotion here.

Or click here to learn how you can trade the SiMSCI futures at just S$1.38*. Or take a view on the markets vis SG Stocks or the STI ETFs now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0