By Danish Lim, Senior Investment Analyst for Phillip Nova

🇸🇬 The Straits Times Index (STI) is widely regarded as Singapore’s benchmark index, comprising 30 of the largest and most liquid stocks on the SGX. While many investors are familiar with these blue-chip names, are there hidden gems outside the STI worth watching? In this Market Trends article, we spotlight 6 promising Singapore stocks not currently in the STI that deserve a spot on your watchlist.

Comfort DelGro

- YTD +4.73% / BBG 12M Tgt Px: S$1.73 / Last Price: S$1.55 / Rtn Potential: +11.6%

Comfort operates across 13 countries and controls SBS Transit, which runs ~31% of SG’s rail system (NEL, DTL, LRT, the other lines are run by SMRT), 54.3% of the public bus market, and 64% of the taxi market.

The UK & Ireland (29% of FY24 revenue) is its largest market outside of SG (51%). Metroline, its UK subsidiary, operates ~17% of London’s bus routes.

Under SG’s Bus Contracting Model (BCM), LTA owns all the assets (buses, etc) and contracts private operators like Comfort to operate public bus services through a tendering process.

Comfort recently successfully extended all 6 negotiated bus contracts under the BCM, helping the company secure long-term revenue streams and reduced operational risk.

Far East Hospitality Trust

- -4.92% YTD / Last Price: S$ 0.58

FEHT owns hotels and serviced residences in Singapore, including Oasia, Rendezvous, and Village Bugis. In February, FEHT made its maiden expansion into Japan with the acquisition of Four Points by Sheraton Nagoya to diversify its portfolio.

Food Empire

- YTD +145.45% / Last Price: $2.43 / BBG 12M Tgt Px: $2.42 / Rtn Potential: -0.4%

A coffee and tea manufacturing company based in Singapore. Brands include instant beverages like flagship MacCoffee, Café Phố, and Klassno; as well as snacks like Kracks. ~30% of FY24 Revenue comes from Russia, while 26% comes from Ukraine, Kazakhstan & CIS markets. SEA is the 2nd largest market at 27% of revenue. Vietnam was Food Empire’s fastest growing market in FY24.

The company recently partnered with Malaysia’s Capital A to co-develop and launch a new range of ready-to-drink beverages, commencing with a Vietnamese iced coffee product set to be sold on AirAsia flights and at selected retail outlets in Asia.

PropNex

- +54.50% YTD / Last Price: $1.46 / BBG 12M Tgt Px: N.A / Rtn Potential: N.A

Propnex operates as a real estate agency. It serves customers in 6 property segments – HDB Resale, Landed Resale, Commercial & Industrial, Project Marketing, Rental, and Private resale. PropNex differentiates itself by having the largest local sales force in Singapore and a 64.2% market share — implying that nearly 2 out of 3 home transactions in Singapore are closed by a PropNex salesperson.

Property demand will be supported by lower interest rates. This comes as sales of million-dollar resale flats in Singapore hit a new record. At the same time, HDB Resale prices are expected to grow by 5%-7% in 2025.

PropNex will also issue a Special dividend of 2.50 cents/share to commemorate its 25th anniversary in 2025. It had a Total dividend of 7.75 cents/share for FY2024 – the highest since listing.

MoneyMax Financial Services

- +93.65% YTD / Last Price: $0.61 / BBG 12M Tgt Px: $N.A / Rtn Potential: N.A

MoneyMax provides financial services through pawnbroking, jewelry retailing, and trading of pre-owned jewelry & watches. The company also provides auto leasing, property financing and insurance services. It has outlets in both Singapore and Malaysia. The stock is viewed as a proxy to gold prices.

FY24 Revenue and Profit grew by 36.5% YoY and 65.4% respectively, as higher gold prices lifted the core jewelry and pawnbroking business.

Banyan Tree Holdings

- YTD +100.00% / Last Price: $0.69/ BBG 12M Tgt Px: $N.A / Rtn Potential: N.A

Banyan Tree is a Singaporean multinational hospitality brand. The group comprises 12 global brands, including the flagship Banyan Tree, Angsana, and Cassia. There were 17 new openings in FY24, notably in Japan, South Korea, and China, featuring Banyan Tree’s debut in Japan with Banyan Tree Higashiyama Kyoto. 10 more properties will open in 2025, including Mandai Rainforest Resort by Banyan Tree. Management expects 31 new hotels to be opened in the next 3 years.

As of Jan 15, 2025, forward bookings for owned hotels saw an 8% YoY increase, driven by Thailand, Japan, Vietnam, and Maldives.

Add these bubbling Singapore market opportunities into your watchlist now!

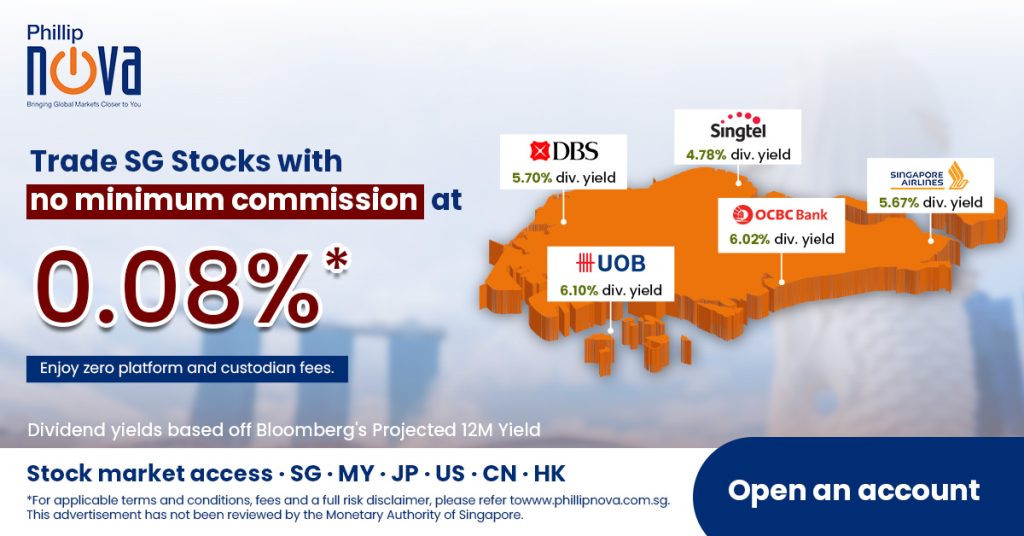

Trade Singapore stocks (with no minimum commission) on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0