New Zealand’s NZ$76bn ($44bn) Super Fund — ranked as the best-performing sovereign wealth fund globally — is tilting away from US equities and betting on Europe for the coming decade, signaling a shift in long-term confidence.

Co-CIOs Brad Dunstan and Will Goodwin told the Financial Times that European equities are now the fund’s largest “overweight” position compared with its reference portfolio. At end-June, the fund was overweight Europe by 2% and underweight US stocks by 3.5%.

Dunstan said that the firm has been short on US and long on the European market based on their market valuations. He added that the positions are taken with a 10 year view in the horizon.

Their strategy reflects a view that European equities, represented by the Stoxx Europe 600, are undervalued relative to US peers. Meanwhile, US stocks — currently trading at about 27.5x earnings versus Europe’s 16x — are seen as overpriced and vulnerable to future rate and inflation risks.

While European equities have lagged in recent months as US earnings remained resilient and tariff fears eased, NZ Super believes the valuation gap will eventually close.

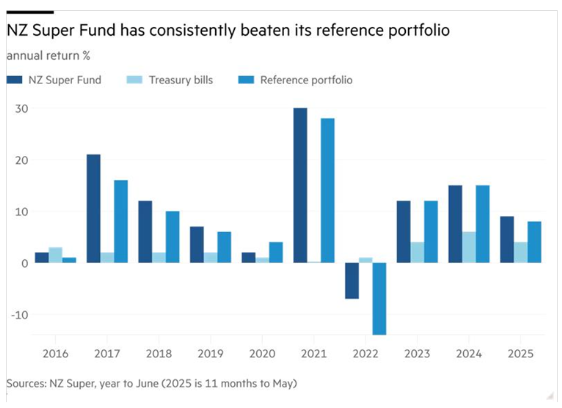

Since its launch in 2003, NZ Super has consistently outperformed peers, delivering annualised returns above 10% over 10- and 20-year periods. Dunstan credits their approach to their portfolio which allows flexibility across asset classes rather than being constrained by rigid allocations.

The fund is also finding opportunities in European private equity, where it can take large positions and build stronger partnerships. Currently, PE makes up about 5% of its portfolio, though Goodwin said it won’t become a major structural allocation.

Overall, the move highlights a growing skepticism among some global investors about stretched US valuations, and a conviction that Europe — despite its challenges — offers better long-term value.

Take a view on the European Markets with Phillip Nova now!

Trade Micro-DAX® and Micro-EURO STOXX 50® Futures at EUR1.50*. Learn more here.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0