US Natural Gas futures for Feb delivery topped $6 for the first time since 2022, back when European demand for US nat gas was booming after it lost supplies from Russia following the Russia-Ukraine invasion.

The February contract reached as high as $7.439, before paring gains to hover around $6.60 as of today at 17:00 SGT.

- This follows a 70% rally last week

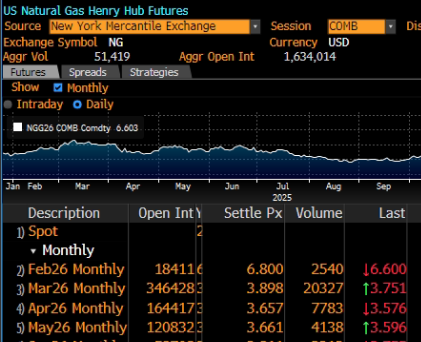

The Feb contract expires on Wed, meaning liquidity is thin, with Open Interest for Feb contract at 18,400 (see below) while Open Interest for the March contract is around 346,000.

This comes amid a winter storm in the US that is estimated to have shutdown ~12% of US nat gas production as the cold weather has frozen pipelines and choked off supply.

- Companies such as Goodyear Bayport, Exxon Mobil, and Celanese corp have shut down their plants due to the weather

Could we see more volatility ahead for Natural Gas Futures?

Take a view via the NYMEX Micro Henry Hub Natural Gas Futures (MNG) Futures at USD0.98* now. Learn more now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0