By Danish Lim, Senior Investment Analyst for Phillip Nova

“This is different in the sense that these companies, the companies that are so highly valued, actually have earnings and stuff like that” – Federal Reserve Chair Jerome Powell

AI Bubble?

- From Big Tech earnings, 2026 CAPEX is expected to be substantially higher than 25’.

- OpenAI committed to spending around $1.4T on AI infrastructure, despite remaining unprofitable.

- Bottlenecks: Electricity, Time for data centre build, GPUs becoming obsolete.

- Key question is whether there is enough future demand from end-users for companies like OpenAI to justify the huge investments being pumped into the industry (ROI?)

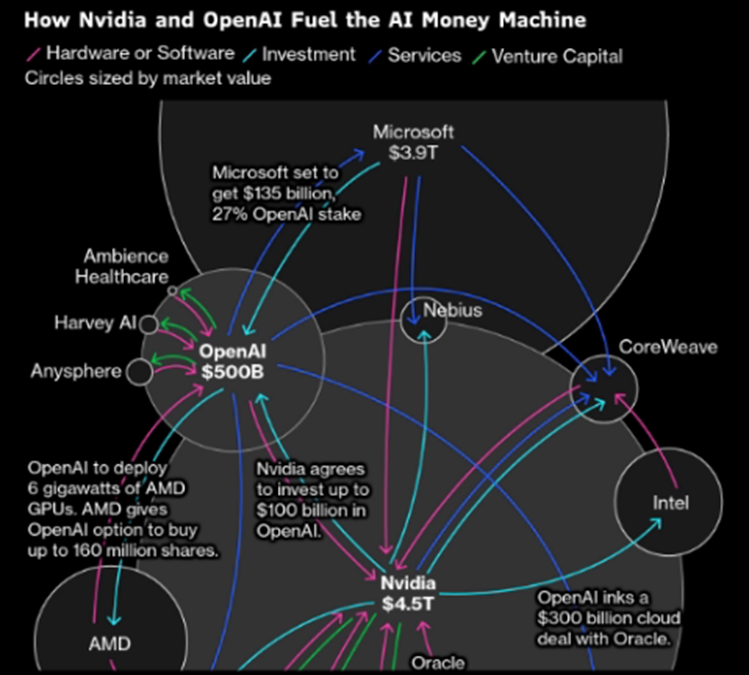

Circular financing/Vendor financing risks.

- The industry has seen a rise in circular financing– essentially referring to where Nvidia invests money into OpenAI for OpenAI to purchase their chips.

- The market is concerned about this as circular/vendor financing was prevalent leading up to the Dot-com bubble, with companies like Nortel Networks even offering up their shares as financing for customers.

- Opinion: From Nvidia’s perspective, this move makes sense business-wise as they are essentially investing into the ecosystem. OpenAI’s success will result in Nvidia’s success. They are essentially incubating a future customer.

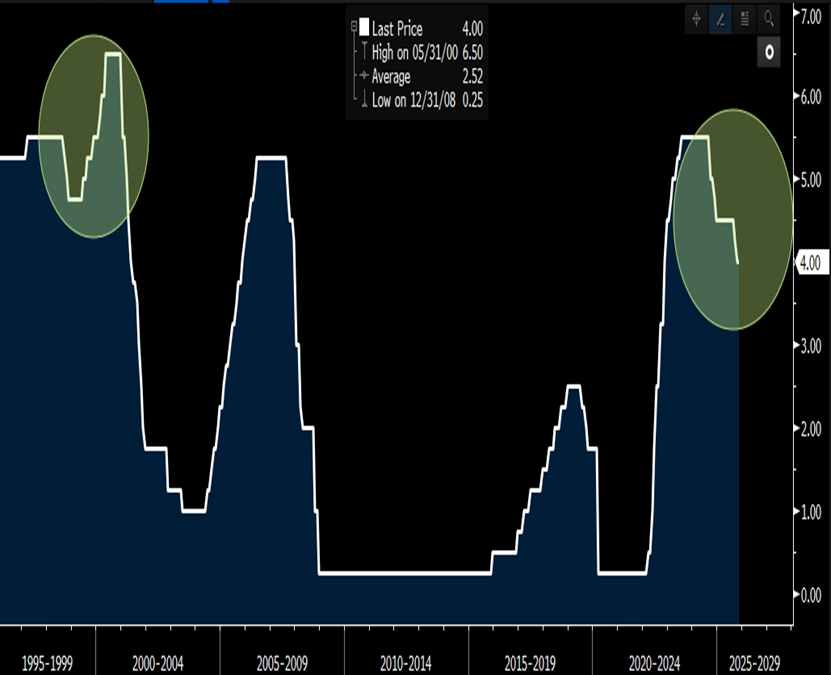

Comparison with Dot-Com Bubble

As we saw in the Dot-com bubble, markets can still crash even if technology turns out beneficial like the internet.

However there are key distinctions between back then and now:

1. Strong financials backing valuations, spending backed mostly by cash, not like debt-heavy Telco providers

2. Different backdrops– Fraud accelerated bubble bursting, with companies like Worldcom found to be cooking their books; also we saw rising rates heading into 00s.

After the dot-com bubble, there was an overcapacity in Telcos, which resulted in lower connectivity charges which made high-speed internet access affordable for everyone. We could see the same this time round.

The ultimate winners were companies which came up with the best business model to monetize the internet, including Ebay’s auction system, Amazon’s e-commerce, airline booking platforms, and Google’s search engine and advertising.

Opportunities: TOP PERFORMERS IN PHILADELPHIA STOCK EXCHANGE SEMICONDUCTOR INDEX (SOX)

Trade AI related and other US stocks on Phillip Nova 2.0 now! Click here to open an account now!

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0